Contact us for help and support

Customers can get in touch with us by secure online message, phone or post. All our contact details are below. You can also read all about our new redemptions virtual assistant.

If you’ve recently received a call, text or voice message from us and are concerned if this is genuine, we’ve included some information below about how we may go about contacting you in this way.

For solicitors or conveyancers, please see our dedicated page for more information about the best way to get in touch, depending on the nature of your query or request.

How to contact us

Self-Serve is our secure online mortgage service, which is available 24 hours a day, 7 days a week.

If your query isn’t urgent, it’s easy to sign in and send us a secure message about a wide variety of topics. If you need a response, we’ll aim to reply within five working days.

Wherever possible, we’ll reply to you by secure message, and you can choose to be notified by text message when we’ve replied.

See our handy step-by-step guide on how to send a secure message below.

You can also use Self-Serve to find key information about your account and carry out many tasks online, without having to call or write to us. Find out more here.

You can write to us at the following address:

Topaz Finance Limited

Gargrave Road

Skipton

BD23 2HL

Please remember to include your name, address and account number in any letters you send.

Solicitors and conveyancers – please see our dedicated page for more information about the best way to get in touch, depending on the nature of your query or request.

Please call us on 0345 389 1672.

You can see our opening hours below, which vary during the week and month.

Our phone lines are often busy, so we apologise for any delay in answering your call.

For general enquiries

- Monday to Friday from 8:30am to 5:30pm.

If you’re having payment difficulties

- Monday – 8:30am to 8pm

- Tuesday – 8:30am to 5:30pm

- Wednesday – 8:30am to 8pm

- Thursday – 8:30am to 5:30pm

- Friday – 8:30am to 5:30pm

- Saturday – 9am to 1pm (we’re only open on the first and last Saturday of each month)

To further support customers, we’re also open from 8am to 8pm on the last working day of each month, on whichever weekday this falls.

If you’re worried about making your monthly mortgage payments or are already struggling, please call us and we’ll try to help. Simply talking to us won’t affect your credit file – and the sooner you get in touch the better, as there are often more ways we can help.

Please note – charges for calling 03 numbers are the same as for calls made to standard UK landline phone numbers starting 01 or 02 and are also included in bundled minutes and unlimited call packages. Calls may be recorded for monitoring and training purposes.

Solicitors and conveyancers – please see our dedicated page for more information about the best way to get in touch, depending on the nature of your query or request.

If something has gone wrong and you want to make a complaint, we’ll do our best to resolve this promptly and fairly.

See how to make a complaint here.

If you’re looking to redeem (pay off) your mortgage – we’re here to help.

We’ve now launched a new redemptions virtual assistant, to help answer your questions about this process.

The redemptions virtual assistant can give you information about:

- Requesting a redemption statement

- Understanding a redemption statement

- Making a redemption payment

- Dealing with a shortfall or surplus payment

- Fees & other costs

- Requesting title deeds

- Removing a charge from a property

So whether you’re a customer or a solicitor – the redemptions virtual assistant could be a quick and easy way to get the information you need.

To use the redemptions virtual assistant, simply click on the small button that’s hovering in the bottom right corner of this page.

You can then start a conversation by asking the redemptions virtual assistant a question, or by selecting one of the handy in-built options.

Please note – the virtual assistant tool will only display and work correctly if you’ve enabled Statistics cookies on this website. You can check or change your preferences on our cookies page.

Using secure messages in Self-Serve

Self-Serve is our secure online mortgage service, which is available 24 hours a day, 7 days a week.

If your query isn’t urgent, it’s easy to sign in and send us a secure message about a wide variety of topics. If you need a response, we’ll aim to reply within five working days. Wherever possible, we’ll reply to you by secure message, and you can choose to be notified by text message when we’ve replied.

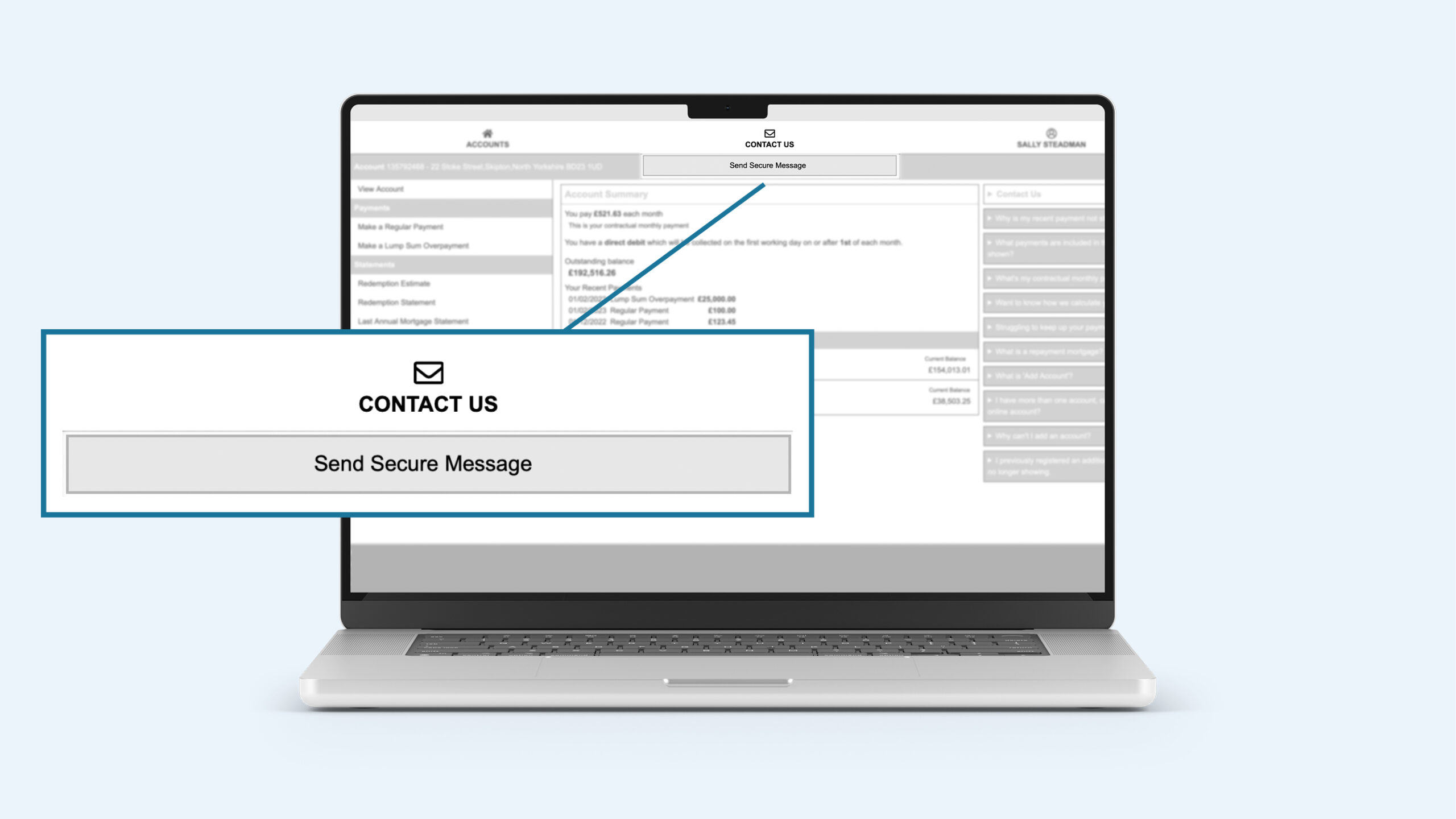

Step 1

Sign-in to Self-Serve and click on the Contact Us button at the top of each screen, then click the Send Secure Message button.

Sign In/Register

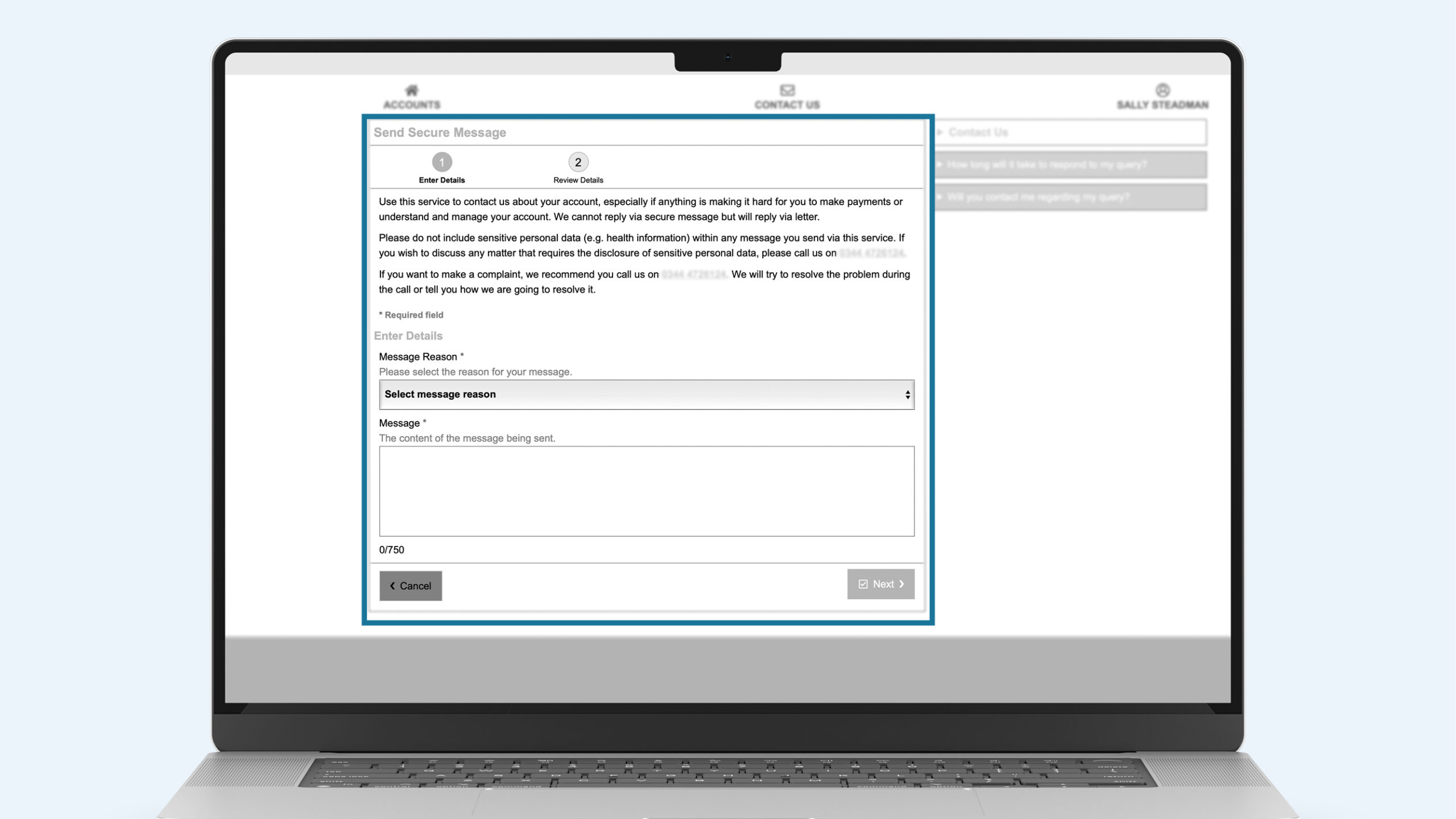

Step 2

Complete the form with details of your message – remembering to tell us if you want us to respond to you. You can select from a range of common customer queries using the drop-down box, or you can choose All other queries and tell us the specific details.

Sign In/Register

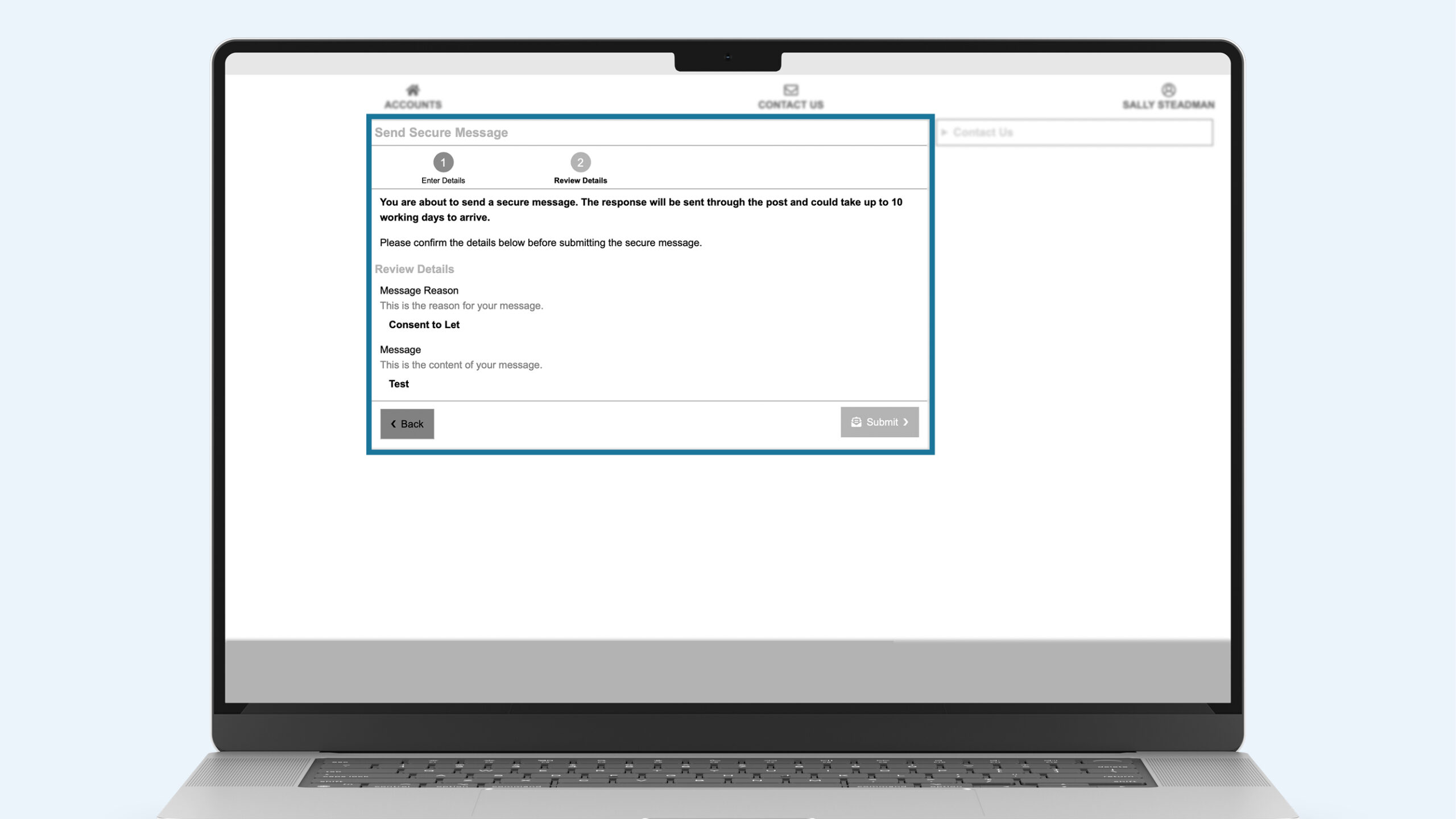

Step 3

Review your message and click Submit. You’ll then see confirmation that we’ve received our message at the top of your Account Summary screen.

Sign In/RegisterOther ways to use Self-Serve

You can also use Self-Serve to find key information about your account and carry out many tasks online, without having to call or write to us:

- Check your monthly payment details, see recent payments made and the total amount you currently owe

- See your remaining term, current interest rate and repayment type

- Find details of your new payment amount, if this is going to change due to an interest rate change

- Make monthly debit card payments quickly and securely

- Check and update your contact or correspondence details

- Make a lump sum overpayment

- Request account information from us, such as a redemption statement.

Find out more – see more details about using Self-Serve here, or see how you can use the system to find out information about your account.

Sign in now – if you’ve already registered on Self-Serve, you can sign in to your account at any time, from any device.

Register now – to use Self-Serve for the first time, you’ll need to register and create your secure account.

Interactive text and voice messages

When we need to tell you something important about your account, to make sure that we get the details to you quickly, we may send a text message or call you. To make it easier for you to respond, we sometimes use interactive text and voice messages, which allow you to send a direct reply. This means that you won’t always need to call us and wait to speak to an agent, and you can also reply at a time that suits you.

When we send you an interactive message, we’ll ask you to verify your identity by responding with your date of birth. Once we’ve confirmed it’s you, we’ll send you further messages about what we need to tell you. We’ll also prompt you to reply to options we present to you by pressing numbers on your phone keypad.

The only personal details we’ll ever ask you for in an interactive message are your date of birth. We’ll never ask you for any other personal information.

We’ll also never ask you for debit card details in an interactive message, or any other personal or financial information. If you’re worried that any message that you receive isn’t from us, please call us and we’ll confirm that it’s genuine.

How to look out for typical phishing indicators

Phishing is when fraudsters try to trick you into revealing personal information. Don’t take the bait! Cybercriminals and fraudsters love to entice us with fake emails and social media posts as well as text messages and voice calls. All with the goal of luring you to provide personal information.

Take a moment to look for any red flags that may indicate the message is potentially fake. Consider questions such as:

- Were you expecting the message?

- Is the language urgent, alarming, or threatening?

- Is the sender requesting financial or login information?

- Is there anything unusual or out of the ordinary about the message?

- Is the greeting very generic?

- Is it poorly crafted with poor spelling and bad grammar?

- Does it contain an offer that’s too good to be true?

If you notice anything suspicious about a message appearing to be from us, please call us to report it. Especially if you have responded to the message with personal or financial information.